Season of Giving: Ways to save on taxes with your charitable contribution

With an increased standard deduction, charitable organizations may be feeling the pinch as the number of people who are filing a Schedule A has decreased significantly. We are here to share with you three tax-saving tips that allow you to continue supporting your favorite charities.

First, let’s understand the difference between Standard Deduction and Itemized Deduction. Standard deduction lowers your income by one fixed amount; itemized deductions are made up of a list of eligible expenses. A tax-saving strategy is to claim whichever type of deduction lowers your tax bill the most.

Tax Tip #1 – Stacking

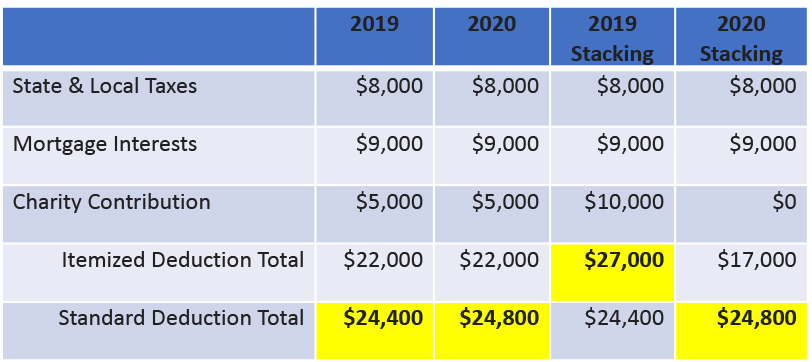

Here’s an example of a “married filing jointly” taxpayer to illustrate this strategy.

As shown above, a taxpayer can save on taxes by stacking – contributing $10,000 in 2019 as oppose to donating $5000 in 2019 and $5000 in 2020.

Tax Tip #2 – Using a Qualified Charitable Distribution (QCD)

If you are receiving a Required Minimum Distribution (RMD) from your IRA, the RMD can be distributed directly to your charity. The amount given will not need to be claimed as income on your personal tax return. If you elect the QCD, you are not allowed to claim this as charity on your Schedule A; no double dipping.

Tax Tip #3 – Donating Appreciated Securities to Charity

Supposing you have $5,000 worth of ABC Stock, and you purchased ABC stock 10 years ago for $1,000. If you sell the stock today, the gain of $4,000 would be subject to a Long-Term Capital Gain (LTCG) tax. But instead, if you donated the stock to a qualified charity, the full $5,000 would be considered a charitable contribution, and you would not incur a LTCG tax on the appreciation.